Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Nov, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Europe’s Tricky Gas Balancing Act

Global energy markets have been rocked by the Russia-Ukraine conflict this year. Amid the loss of the Nord Stream gas pipeline and sanctions on Russia, Europe faces an energy crisis marked by high prices and low supply, according to S&P Global Commodity Insights.

As the critical winter heating season approaches, concerns are growing about the continent’s energy security — and whether the region has enough natural gas to make it through.

“The European gas market has never been in a more precarious state,” said Stuart Elliott, associate editorial director for European power and gas at S&P Global Commodity Insights, speaking on the division’s "Commodities Focus" podcast.

With a very mild winter, Europe should be able to make it through with the gas it has in storage. But if the season is colder than usual, there could be additional demand of as much as 30 billion cubic meters to 40 Bcm, leaving stocks “down to close to nothing,” Elliott said.

Also speaking on the podcast, Kira Savcenko, European power and gas editor for S&P Global Commodity Insights, said Europe was well supplied with coal. Europe’s renewable energy resources, on the other hand, can only help so much because “the systems are very limited to how much they can store … and moreover, they are pretty complex to operate,” Savcenko said.

Some industry observers have struck a different note. At Columbia University’s Global Energy Summit in New York on Oct. 12, Iain Conn, former CEO of multinational energy company Centrica, gave a more optimistic outlook. “Europe is on a path to offset Russian gas supply … through a combination of fuel switching, increased liquefied natural gas imports, and efficiency and rationing,” Conn said.

But fears remain about the region’s energy security. On Oct. 16, the CEO of Gazprom, an energy company majority-owned by the Russian government, threatened to halt gas supplies to the EU entirely if the bloc places a price cap on gas.

Tatiana Mitrova, a research fellow at Columbia University’s Center on Global Energy Policy, told S&P Global Commodity Insights that “many people in Europe and the U.S. do not fully understand that Moscow believes it is locked in a ‘hybrid war’ with the collective West.”

EU member states are undecided about how or whether to introduce a price cap, according to S&P Global Commodity Insights. S&P Global Market Intelligence expects prices to stay high through 2023 and possibly not to stabilize until 2026. A price cap may hurt efforts to lower demand, leading to gas shortages.

Looking to next year, energy markets will retain the ability to surprise, said S&P Global Commodity Insights’ Elliott, who noted that reducing overall demand may prove to be Europe’s best bet for conserving precious gas supplies.

“If there’s anything the past year has taught us, it’s don’t be surprised by anything anymore,” Elliott said. “I think the really important thing to stress is that demand reduction is the only true way to … make sure we are able to get through the winter.”

Today is Wednesday, November 16, 2022, and here is today’s essential intelligence.

Written by Claire Delano.

Monthly PMI Bulletin: November 2022

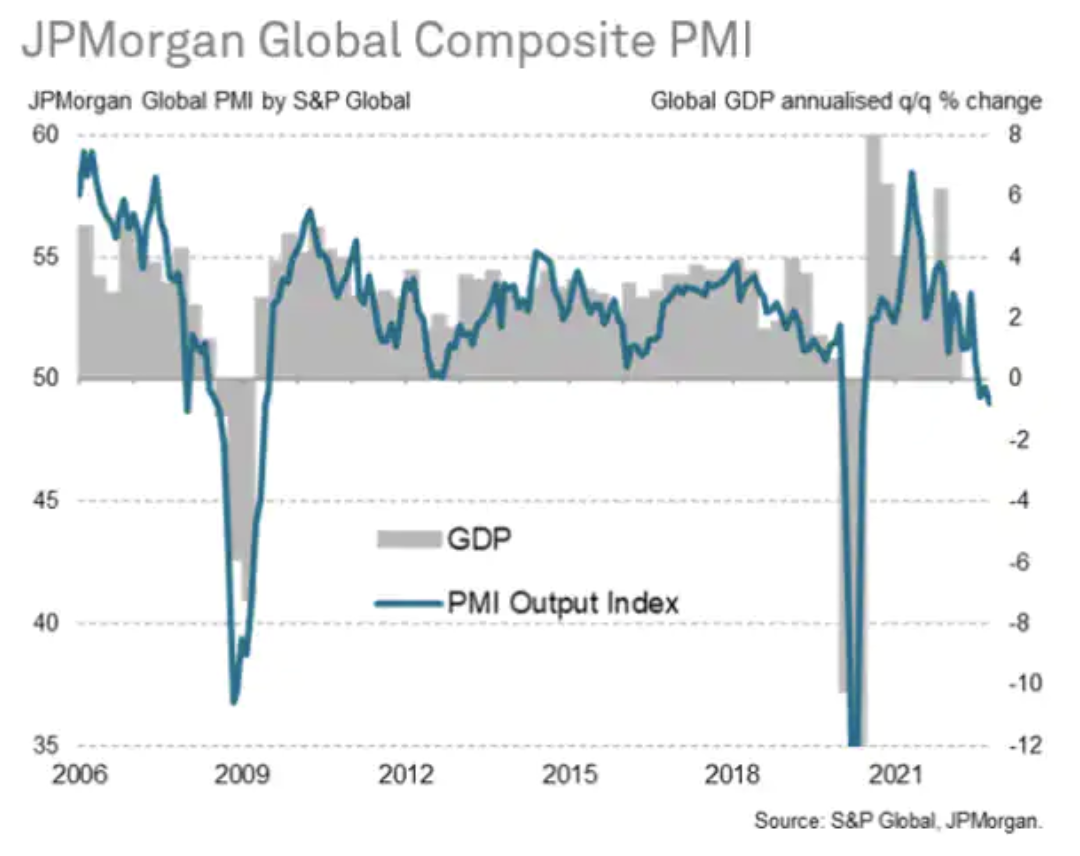

The global slowdown deepened at the start of the fourth quarter with both manufacturing and services performance deteriorating and output contracting at a faster rate. Demand conditions worsened while prices remained elevated despite inflationary pressures easing. Concurrently, business confidence fell sharply in October. The J.P. Morgan Global Composite Output Index — produced by S&P Global — posted 49.0 in October, down from 49.6 in September. This marked the third straight month of global contraction and at the fastest pace since June 2020, albeit still mild overall.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Higher Rates Could Pressure Singapore Banks' Loan Growth As Growth Levels Off

Singapore's major banks face slowing loan growth in 2023, weighed by monetary tightening and a weaker outlook for economies in Asia-Pacific as central banks remain focused on inflation control. Rising interest rates since late 2021 have so far helped Singapore's biggest lenders by assets, DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd., or OCBC, and United Overseas Bank Ltd., or UOB. All three reported record profits in the third quarter ended Sept. 30 as higher rates buoyed their net interest margins. But as rates continue to rise, they could impede borrowing, analysts said.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

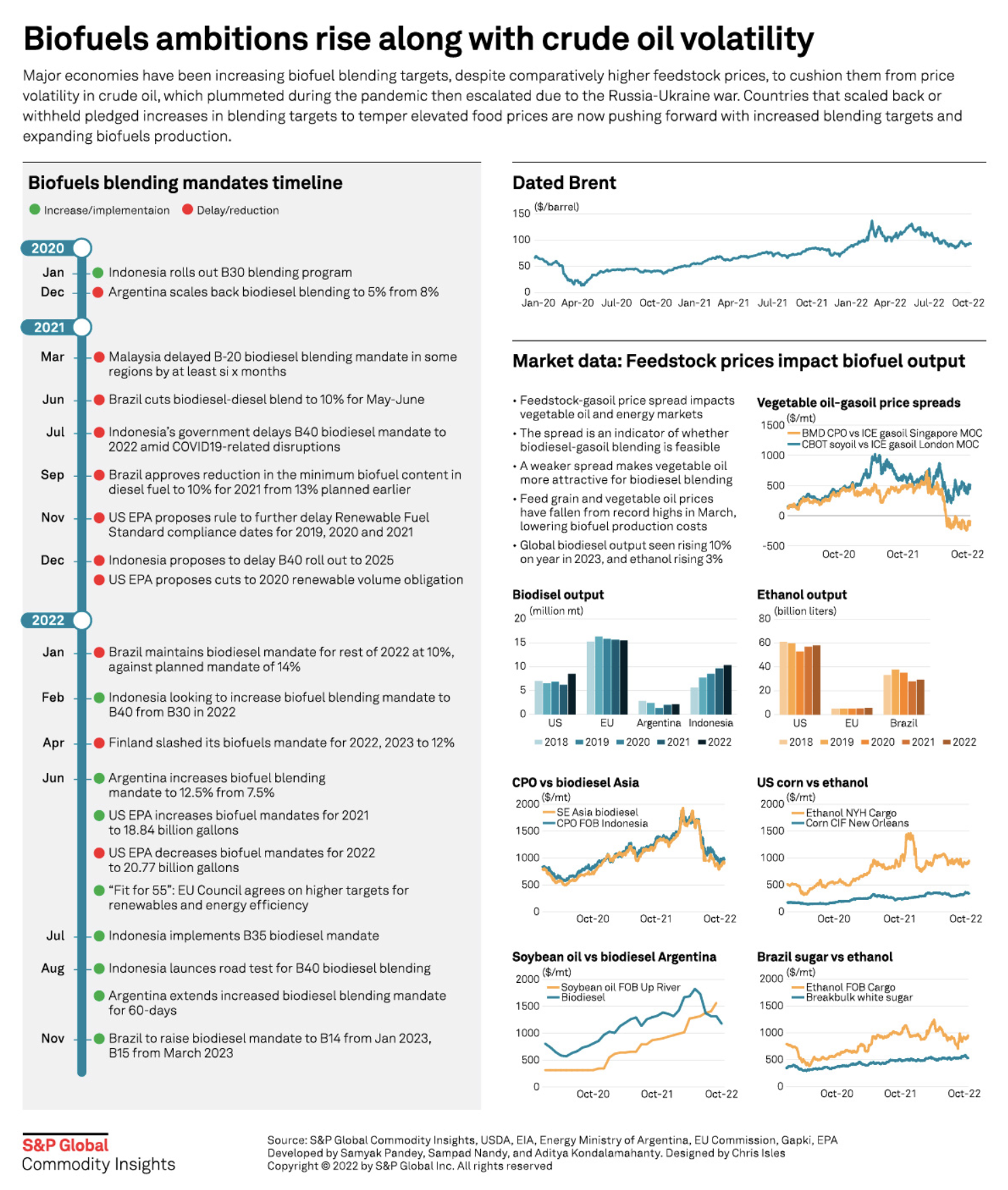

Infographic: Biofuels Ambitions Rise Along With Crude Oil Volatility

Major economies have been increasing biofuel blending targets, despite comparatively higher feedstock prices, to cushion them from price volatility in crude oil, which plummeted during the pandemic then escalated due to the Russia-Ukraine war. Countries that scaled back or withheld pledged increases in blending targets to temper elevated food prices are now pushing forward with increased blending targets and expanding biofuels production.

—View the infographic from S&P Global Commodity Insights

Access more insights on global trade >

Reversing The Entropy Of Climate Change

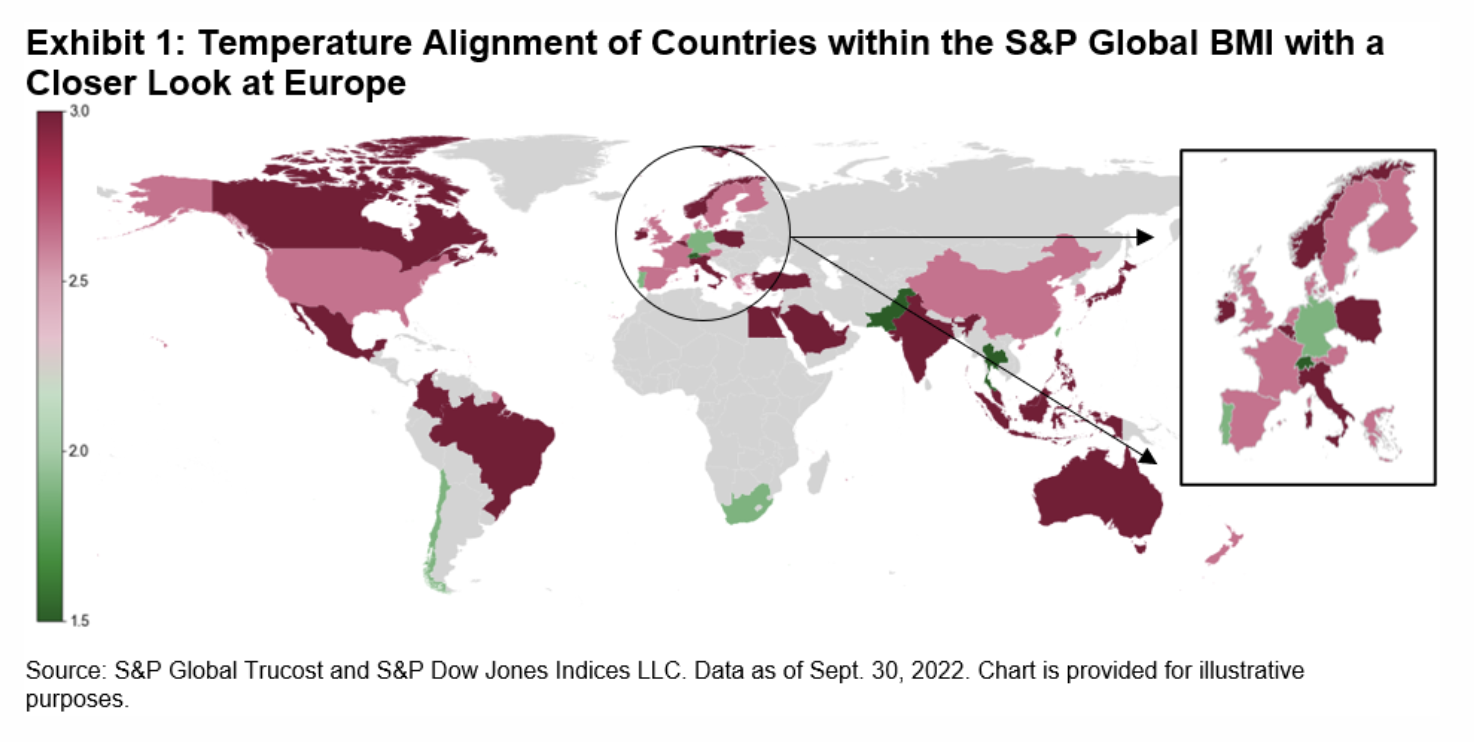

According to the second law of thermodynamics, the state of disorder or chaos of a system, also known as entropy, increases over time, defining the so-called arrow of time. Applying this analogy to Earth, is the world headed into chaos as climate change unfolds? Not necessarily. Just as entropy can decrease if useful work is put into it — think of a freezer turning water to ice — so is the world able to prevent the worst impacts from climate change.

—Read the article from S&P Dow Jones Indices

Access more insights on sustainability >

Listen: Middle East Promotes Compatibility Of Energy Security And Energy Transition

Gulf countries attending the ADIPEC conference in October made it clear that oil and gas will be needed for decades to come, and the region has the least carbon-intensive barrels to fuel a global economy seeking to lower its emissions. How does this play against the United Nations' assertion that new hydrocarbon investments are incompatible with credible net-zero targets? S&P Global Commodity Insights news editors Dania El Saadi and Henry Edwardes-Evans compare notes.

—Listen and subscribe to Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 91: Fostering Inclusivity In Technology

Technology pervades many aspects of life, and it’s critical to ensure that we’re building it with inclusivity in mind. Sonal Sakhardande, Technology Group Director for Markit Digital, joins host Eric Hanselman to explore considerations to expand inclusivity in technology teams and the things they develop. While building diverse teams can go a long way to bringing wider viewpoints to a project, the team and their efforts have to be supported by their organizations.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence